2025 Finance App Design Blueprint

Welcome to the World of FinTech Development

Hey there, aspiring fintech wizard! If you’re looking to turn a bright idea into a bank‑grade app, you’re in the right place. Below we’ll walk you through the easiest way to design, build, and launch a mobile financial product that’s both slick and secure.

1⃣ Find Your Sweet Spot

Scope matters. Pick a niche that sparks your passion—Pin‑out for small businesses, AI‑driven budgeting, or maybe a QR‑pay solution for coffee shops. The smaller the space, the easier it is to stand out.

2⃣ Do Your Homework

Keep your finger on the pulse. Gather data on:

- Competitors (what’s their move, what’s missing?)

- User pain points (why does the market sigh?)

- Regulation traps (one wrong step and you’re out of business)

3⃣ Sketch the Blueprint

Turn your ideas into wireframes. Think about:

- Journey flow (where do users start and finish?)

- Rapid prototypes (clickable mock‑ups that feel like real app)

- Feedback loops (share early with friends, see what bugs bite)

4⃣ Design With a Purpose

Take your interface from drab to fab:

- Use clean layouts, vibrant colors that guide the eye.

- Make navigation intuitive (“Find it, don’t look for it”).

- Accessibility is key (contrast, font size, voice‑over).

5⃣ Code and Release

Build with the tools you love, but also boot up a heavy stack:

- Choose a language (Java, Kotlin, Swift, or cross‑platform like React Native).

- Integrate secure SDKs for payments and identity.

- Test, test, test. Use unit tests, UI tests, and load testing.

- Deploy. Go live, but watch closely—monitor crashes, latency, and of course, security alerts.

Quick 1‑Pager for Mobile FinTech Developers

Understand the Field

- Read up on the latest fintech trends.

- Know the regulatory landscape in your target markets.

Prioritize Security

- Use end‑to‑end encryption.

- Follow industry best practices for data storage.

- Do regular penetration tests.

Listen to Users

- Early beta users are gold.

- Collect real‑world feedback and iterate.

Pick the Right Tech

- Choose frameworks that support swift APIs and compliance.

- Account for scalability—your app should handle a sudden surge of users.

Embrace New Technologies

- Like blockchain for transparency, or AI for smart budgeting.

- Stay flexible—technology evolves fast.

There you have it: a simple, friendly roadmap to launch a fintech app from concept to coin. Keep it human‑centric, keep it secure, and most importantly—have fun building it! Happy coding, and may your app’s success be as inevitable as a heartbeat.

Introduction

FinTech: The Digital Gold Rush

In today’s world, tech isn’t just a buzzword – it’s the powerhouse behind every new‑age financial venture. Whether a startup is sprouting up or an established firm is reimagining its services, innovation is the name of the game. In other words, if you want to stay relevant, you need that tech sparkle.

What Exactly Is FinTech?

Think of FinTech as a bustling ecosystem where online payments, electronic banking, alternative finance, big data, and money‑management magic all hang out together. They’re the secret sauce that turns everyday transactions into lightning‑fast, user‑friendly experiences. Plus, the mobile apps that rule this space are rewriting the banking rulebook, one tap at a time.

Geniusee’s Personal Touch

Geniusee doesn’t just geek out on gadgets; they tailor solutions to fit each client’s quirks. This bespoke approach means folks feel the difference – smoother customer journeys, automated tasks, and businesses that actually thrive.

Why Now Is a Game‑Changer

- America is humming with roughly 5,700 FinTech companies, all growing like a well‑fed cryptocurrency.

- Whatever your current status – from “already doing it” to “just day‑dreaming” – the market is ripe for the picking.

- Feeling swamped by trends, rules, and box‑checks? Don’t worry. Below are quick pointers to get you rolling.

Quick Start Guide for Your FinTech Mobile App

1. Dream Big, Start Small – sketch out the core feature set, then iterate. 2. Stay Regulatory‑Ready – knowledge of data privacy and compliance is a must. 3. Keep the User in Mind – intentional UX wins hearts (and wallets). 4. Embrace Data Wisely – use analytics to fine‑tune instead of drowning in numbers. 5. Build With Scalability – preparation for growth now saves headaches later.

At the end of the day, FinTech is all about making money feel a bit more human and a lot less clunky. If you’re ready to dive into this digital dancefloor, remember: the next big payment app could be just a brainstorm away. Good luck, and may your code be bug‑free and your users always smiling!

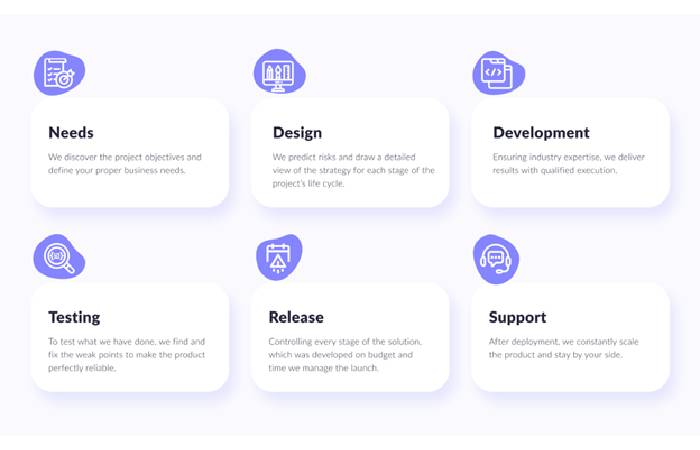

Main Steps Of FinTech Application Development

1. Preferable Niche

The FinTech Adventure Begins: Picking Your Niche

Imagine you’re an explorer without treasure maps. Without knowing where to head, you’ll end up in a swamp of confused ideas. Before you dive into code, ask yourself:

- What problem will you solve? Think of it as choosing a genre – finance, payments, lending, or maybe insurance.

- Who are the audience? Young professionals, SMEs, or retirees? Knowing this shapes every feature.

- Why now? Gather trends or gaps in the market – a gap is your launchpad!

Once you lock in that niche, it’s time to sketch the big picture of the project.

What the Future App Will Do (Your Feature Blueprint)

- Core Functionalities:

- Seamless account linking across banks.

- Real‑time credit scoring with a dash of AI.

- Micro‑investment rounds that feel like stocking the pantry.

- Buzz‑worthy Extras:

- Gamified savings challenges (think “Streaks & Stakes”).

- Instant tax‑reporting, because nobody likes late paperwork.

- Chatbot concierge for step‑by‑step guidance.

Step‑by‑Step Walkthrough (Your Project Roadtrip)

- Kick‑off: Gather stakeholders, define MVP, and jot down user stories.

- Design Sprint: Create wireframes, validate with real users, tweak on the fly.

- Build Phase: Write code, integrate APIs, keep testing tight.

- Beta Release: Invite a select crowd, collect feedback, fine‑tune bugs.

- Grand Launch: Push to the app store, shout on socials, and celebrate!

Tech Stack Essentials (Your Toolbox)

- Front‑end: React Native or Flutter – build once, play on many.

- Back‑end: Node.js + Express or Python Django – because performance matters.

- Database: PostgreSQL or MongoDB – choose the one that feels like home.

- Security: OAuth 2.0, encryption at rest, and rigorous audits.

- Analytics: Google Analytics or Mixpanel – keep an eye on user happiness.

- DevOps: Docker, CI/CD pipelines, auto‑scaling on AWS or Azure.

Scope & Milestones (Your Checklist)

- Month 1–2: Research & Planning

- Finalize niche, define user personas, create a product roadmap.

- Month 3–4: Design & Prototype

- Build interactive prototypes, conduct usability tests.

- Month 5–7: MVP Development

- Core features coded, unit tests added, first round of QA.

- Month 8–9: Beta Rollout

- Select users, gather feedback, squash critical bugs.

- Month 10–12: Public Launch & Iterate

- Full launch, marketing push, continual feature updates based on data.

With this roadmap, you’re not just developing software—you’re crafting a FinTech experience that feels like the future is now. Keep the humor light, the features sharp, and the milestones on track, and you’ll turn your idea into a user‑loving success story.

2. Market Research

Technical Assignment for Developers

1. Project Overview

| Element | Details |

|---|---|

| Vision | Offer a seamless, personalized shopping experience on iOS and Android. |

| Scope | Core e‑commerce functions, push‑notifications, payment integration, and analytics. |

| Timeline | 6 months: 4 weeks analysis → 4 weeks design → 9 weeks development → 3 weeks testing → 1 week launch. |

| Stakeholders | Product Owner, UI/UX Designer, QA Lead, Backend Engineer, Frontend Engineer, DevOps, Marketing. |

2. Market & Audience Analysis

3. Competitor Landscape

| Competitor | Strengths | Weaknesses | Opportunity for ShopEase |

|---|---|---|---|

| Amazon Mobile | Massive catalog, fast shipping. | Heavy ads, data privacy concerns. | Offer lighter UI, transparent pricing. |

| Shopify App | Easy business onboarding. | Limited to e‑commerce, heavy subscription costs. | Provide free tier for small sellers, easier analytics. |

| WooCommerce | Open‑source flexibility. | Requires technical knowledge. | Build a no‑code app builder. |

4. Functional Requirements

5. Non‑Functional Requirements

| Requirement | Acceptance Criteria |

|---|---|

| Performance | < 2 s page render on 4G; max 3 s on 3G. |

| Scalability | Handle 10k concurrent users; auto‑scale in cloud. |

| Security | OWASP Top 10 compliance; GDPR & CCPA compliant. |

| Usability | 90%+ satisfaction on usability testing; 5‑star rating in UI/UX review. |

| Reliability | 99.9% uptime; automatic failover. |

6. Architecture Overview

7. Development Plan

| Sprint | Tasks | Owner |

|---|---|---|

| Sprint 1 | Set up repo, CI pipeline, baseline skeleton. | DevOps |

| Sprint 2 | Implement auth, basic UI screens. | Frontend |

| Sprint 3 | Create admin CRUD, product APIs. | Backend |

| Sprint 4 | Integrate payment gateway, test security. | Backend |

| Sprint 5 | Add push notifications, analytics tracker. | Full Stack |

| Sprint 6 | QA, bug‑fix, performance tuning. | QA |

| Sprint 7 | Beta launch, collect feedback, iterate. | Product Owner |

8. Testing Strategy

9. Deployment & Release

10. Risk & Mitigation

| Risk | Impact | Mitigation |

|---|---|---|

| Delayed API integration | Schedule shift | Use mock services, hold separate sprint. |

| Security breaches | Reputation loss | CI security scans, penetration testing. |

| Performance bottlenecks | Poor UX | Profile, cache critical queries, CDN. |

| Regulatory changes | Compliance failure | Legal review, flexible data architecture. |

Please review the assignment and let us know if any adjustments are required before kickoff.

3. Prototyping

Mastering UI/UX: Turning the Crystal‑Ball into a User’s Best Friend

Picture this: your app is a fancy, high‑tech Swiss army knife, but the user who opens it feels like they’re staring at it with empty glasses.

Why Simplicity Wins

Everybody loves a good shortcut. The goal is to let people finish a task in record time—imagine a fast‑lane parking app in a world of convoluted ticket booths.

- Keep It Short: Limit the steps to the absolute minimum. Each tap should feel like pulling a lever, not pulling a snake.

- Guide, Don’t Lecture: Use subtle prompts, progress bars, and “you’re almost there” messages—no intimidating tutorials.

- Speak Their Language: Avoid finance jargon. Replace “liquid assets” with “quick cash.”

- Visual Cues Matter: Icons that look like a dollar sign or a thumbs‑up can save a second and a second of confusion.

- Test, Repeat, Repeat: Get thumbs‑up from folks who’ve never traded a penny. If they’re confused, tweak.

Quick Takeaway

Make your product as user‑friendly as picking up a sandwich from a deli. Break down the hustle, add a touch of humor, and let the interface do the heavy lifting—so even a non‑savvy person can navigate with a grin.

4. Developing Design Elements

Putting the Interface Pieces in Their Spot

Now it’s the moment to hand‑craft the components that make up your app’s visual identity. Think of it like assembling a custom Lego set—every brick (or button, input field, card, etc.) should fit the vibe you’ve chosen. Here’s how to nail it:

- Stick to your design system – use the colors, fonts, and spacing that define your brand personality.

- Keep it consistent – each component should mirror the siblings in layout and behavior.

- Test for usability – quick interactions or tests will help spot any awkward glitch before launch.

Rolling Out the Navigation

Next up is smooth navigation. If your app were a city, this is the best GPS you can provide. Here’s the playbook:

- Clear pathways – users should instantly know how to move from one part of the app to another.

- Intuitive menus – think about where your audience expects to find the ‘settings’ or ‘home’ button.

- Fast route‑finders – lazy users love speed, so minimize the steps needed to reach their goal.

The Final Touches

Once the UI pieces and navigation are in place, the app feels like a well‑orchestrated dance—each component stepping in sync with a smooth flow. Give your users a seamless experience, and they’ll be glad they found your app in the first place.

5. Programming And Launch

Time to Dive Into the Tech Stack

With the design now approved, it’s time to pick the tech that will power the app. Think of it as choosing the right gear before a big hike.

What’s Involved in This Step?

- Code the Features – Turning the creative visions into working functionality.

- Pick the Tech Mix – From frameworks to databases, make sure each piece fits perfectly.

- Secure the Fortress – Implement the best security practices to keep the data safe.

Keep your mindset light, your code tight, and you’ll be set to build something awesome!

Simple Tips For Mobile FinTech Developers

FinTech App Development: Surviving the Jungle

Why the Fight is Hefty

Technology’s cash splash is making the FinTech arena buzz louder than a street‑market concert. Every day, a new app pops up, throwing more rivalry into the mix. The good news? The market’s hungry—so there’s room for every innovative idea that can keep its customers smiling.

Top Tricks to Stay on Track

- Know Your Audience: Dive into the needs of each user slice—whether they’re trust‑seeking retirees or high‑speed traders.

- Simplify the Experience: Think of your UI like a friendly barista: quick, intuitive, and never forgets a regular’s name.

- Security Is Your Best Friend: Push encryption to the front and back spots, like a superhero cape that swoops every time data moves.

- Leverage AI Wisely: A sprinkle of machine learning can predict trends faster than the last coffee order on a rainy morning.

- Iterate Faster Than a Ticker: Release MVPs, collect feedback, and roll upgrades like a pro DJ plays new tracks.

Keep It Real — The Human Touch

Remember, behind every code line are folks who need solutions, not just tech. Inject a bit of humor, show genuine care, and watch your balance sheets grow and your customer loyalty soar.

Examine And Understand FinTech

FinTech 101: Beyond Just Knowing How to Code

Everyone loves the shiny tech side of FinTech, but let’s get real: being a coding guru is only part of the puzzle. The financial side of the industry is a full-blown world on its own.

Why Tech‑Savvy Alone Won’t Cut It

- Financial Workflow Matters – Understanding how money moves through a system is as crucial as writing the code that moves it.

- Regulatory Rules – Compliance isn’t optional; it’s the power‑up that lets a platform run smoothly.

- Business Strategy – FinTech solutions solve real problems; you need to know what those problems are.

Tips to Level Up Your FinTech Knowledge

Feeling that need to brush up? Try these quick hacks:

- Read the Basics – Dive into classic finance textbooks or popular financial blogs.

- Follow the Flow – Map out a typical transaction from start to finish and spot where tech makes the difference.

- Talk to the Experts – Chat with bankers, compliance officers, and product managers; their perspectives are gold.

- Play Simulations – Many online platforms let you simulate trades or loans; it’s a fun way to see theory in action.

Bottom Line

Being a FinTech pro means blurring the lines between code and money. If you mix tech flair with financial acumen, you’ll be ready to build solutions that actually make people’s wallets smile.

Consider The Security Aspect

Keeping Your Users’ Secrets Safe (Because They’ve Got Your Back)

Why it Matters

When people hand over their personal info, they’re basically letting you show them their diary. You’ve got to treat that diary with the same love and care you’d give your own private album. That’s the bedrock of trust.

Step One: Build the Fortress

- Backend Gotchas: Build a solid backend wrapped in reliable proxies and firewalls. Think of it as a digital moat that keeps bazaars and bandits at bay.

- Keep your servers up‑to‑date and make sure no one gets a “cron job” cheat sheet to your secrets.

- Segregate data layers – never let public and private sections mingle like a bad office Christmas party.

Step Two: Light the Firewalls

Firewalls aren’t just for tech nerds; they’re the gatekeepers that shout “I’m not letting any looser in!” So, firewalls should be configured hard and tested early.

Step Three: Put on Your Hacker Pants

- Run load tests that mimic a hacker’s worst nightmare. Think of this as a polite “test your limits” session—don’t stress out, just make sure you’re bullet‑proof.

- Use tools that simulate realistic attacks: SQL injection, DDoS, brute‑force, the full set.

- End every test with a thorough audit—list every weakness, fix it, then test again.

Why You Should Care

Your users think you’re their digital guardian. If you play your cards right (good security, no breaches), you’ll earn loyalty, trust, and maybe even fan mail. If you slip up, you’ll have a scorching reputation for a long time.

Final Thought

Remember: protecting privacy isn’t just a task—it’s a promise you make to every person who entrusts you with a story. Treat it like the sacred scroll you’re handing over to a client. And keep those doors locked.

Listen To Your Users

Why Listening to Feedback is Your Secret Weapon

Hey there, quick heads‑up! If you want to breeze through your projects, you’ve got to hearken to those suggestions and criticisms. They’re like cheat codes for saving time and turbo‑charging your development flow.

What You Should Do

- Grab the advice. Make it a habit to grab every nugget of feedback from users.

- Put it into action. Read it, think it over, and then show up with the changes.

- Enjoy the savings. By acting smartly, you cut down on those extra hours and keep the project moving.

In a nutshell, the smarter you listen, the faster you grow.

Make Sure You Select the Correct Technology

Building Fintech That Outlasts the Future

*Fintech apps are the new superheroes of the financial world—but unlike capes that devolve after a few comic runs, your platform needs to stick around.

“Future‑proofing is less about flashy tech and more about smart choices.”

Why It Matters

*What to Do

*- Pick a platform that is modular and easily upgradeable.

- Ensure interoperability with both new APIs and legacy interfaces.

- Keep your tech stack light enough to adapt but heavy enough to impress.

Final Thought

*Think of your fintech project as a well‑tuned orchestra: each instrument (platform, tech, partner) must play in harmony, and the score (the user’s experience) should keep winning applause for years to come.

Implement New Technologies

Mobile FinTech: Turning Innovation Into Gold

Innovation isn’t just a buzzword—it’s the lifeblood of mobile financial technology. Think of it as the secret sauce that keeps apps fresh, users hooked, and competitors on their toes.

Why Blockchain Bites the Bite

Picture blockchain as a digital ledger that never forgets—clear, tamper‑proof, and ready to roll out “smart contracts.” It’s the ideal sidekick for:

- Secure record‑keeping—every transaction is time‑stamped and verifiable.

- Transparent reimbursements—no more shady middlemen, just clear, auditable trails.

- Decentralized trust—the more nodes, the stronger the chain.

AI: The Data Whisperer and Chatbot Guru

Artificial intelligence isn’t just a puzzle; it’s the star of the show. AI can:

- Analyze heaps of data—helping banks spot trends faster than you can say “inflation.”

- Power personable chatbots—they’re like having a well‑educated, 24/7 personal assistant who doesn’t need a coffee break.

- Facilitate customer interactions—from quick FAQs to complex financial advice, all delivered with a human touch.

Competition? Check. Digitization? Check. Opportunity? Double Check!

Sure, the fintech arena is getting crowded—every new app feels like a gang of street‑wise tech startups. Yet, the global marketplace is practically a hungry buffet, ready to devour fresh ideas and bold projects.

So grab your tech toolbox, mix blockchain with some AI, sprinkle a dash of humor, and watch the FinTech world light up!